Founder and CEO of Caber Hill Advisors Craig Castelli details the stages of a typical deal when working with the Caber Hill team. Watching this video, middle-market business owners can expect to learn how the advisors prepare a business for sale, what criteria goes into building a custom buyers’ list, how long a sale process typically takes, and much more. Watch as Castelli walks through the phases, process, timeline, and benefits of selling your business with the Caber Hill team in your corner. Scroll further to find a transcript of the video.

[Transcript]

Introduction

When you work with CH, you should expect that you have a highly experienced and qualified team working with you throughout the entire deal process driving toward that outcome that you’re seeking.

Phases of a Deal

Our engagements are typically 6 to 9 months, and we divide the engagement into three phases.

The first is the pre-launch phase, this is when we’re performing our due diligence on the company and preparing an ownership or management team for going to market.

The second phase is the launch phase, this is when we’re actually putting the company on the market and negotiating the bids with the buyers.

The final stage is due diligence and closing, this occurs when we’ve signed a letter of intent with a buyer, and we’re walking down the path with them to close the deal.

Pre-launch: Preparing a Business for Market

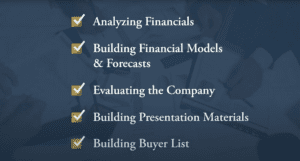

This first phase, the pre-launch phase – we’re analyzing financials, building financial models and forecasts, doing evaluation on the company, building presentation materials, building a buyer list, getting everything prepped to put the company on the market.

We’re doing most of the work, but we’re doing this in partnership with the ownership or management team so that they can ensure that the buyer list aligns with their objectives.

They can ensure that the presentation materials are accurate reflections of the history of the company, how it should be positioned, and where the company is going.

Launch: Buyer Search

Once we are ready, we put the business on the market, we’ve built a buyer list, and we are contacting every single buyer directly.

We’re not putting out ads in the Wall Street Journal or business for sale sites, or other public forums.

It’s a process designed to very specifically target the relevant best buyers for the company while also ensuring we maintain confidentiality throughout.

At this point, we turn on a calendar and we have a very specific, detailed schedule of milestone dates that both we and the buyers have to hit to keep the process moving.

Benefits of a Competitive Auction

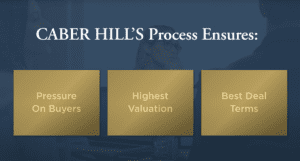

By following this process, it keeps pressure on the buyers and ensures that they know that they are competing with others.

It drives the highest valuation and the best deal terms.

The way that this works is once the buyers are contacted, they receive what’s called a teaser – a one-page, non-confidential summary of the company that gives them enough information to determine if it’s a company they’d like to buy or invest in but not so much they could actually figure out who the company is.

If they want to learn more, they sign a non-disclosure agreement.

Once they sign that NDA, we give them access to the presentation materials and financial models, and they’re given about two weeks to submit their first-round bid – we call it an Indication of Interest.

They’re going to give us a valuation-to-valuation range and the key details that we need to know at this time to determine if there’s somebody that we want to engage with further.

In a typical deal process, we may receive 15 to 20 of these Indications of Interest, and our goal is to narrow this down to the best four to six buyers amongst that larger pool.

Those four to six are invited to management meetings which will occur over a one to two-week period of time in which we are spending a half-day meeting with these buyers.

It’s a mutual interview process.

Management Meeting Goals

The buyers come in prepared with a number of questions that they need answered in order to confirm their valuation and prepare themselves to issue their second-round bid, which we call a letter of intent.

It’s also a chance for the seller to ask the buyer questions and get to know them and look beyond just the numbers at who they are potentially selling their company to and how good of a fit this is.

The buyer is knowing that this is competitive; they’re coming in to put a sales pitch on too.

So, it really does allow both sides to dig deeper into the other and determine fit.

Once we get through the meetings, the second-round bids are due.

We typically have in our mind a top one, two, or three buyers coming out of those meetings.

Final Negotiations

We’re going to keep negotiating with that small group until we have the deal that we’re comfortable with, with one of them.

We’re going to sign a Letter of Intent, that’s going to move us through to the closing.

Post-launch: Due Diligence

This is when the buyers get to conduct extensive due diligence.

They’re bringing in accounting teams to analyze the numbers and beat up everything we’ve presented.

We have our own analyst team working directly with those accounting teams to confirm the numbers and make sure that we’re seeing things the same way and the valuation holds.

This is also when the lawyers get engaged, and they duke it out over all the agreements.

We remain very involved in that part of the process as well because there are always times where the lawyers reach a stalemate, and the business folks have to get together and resolve an issue.

Every single deal, I or one of my partners is picking up the phone and calling the Private Equity partner or CEO on the other side to hash out some issue because the attorneys have reached a stalemate.

It’s this type of team approach that really drives the success rates and ensures that we get a successful closing.

Typical Timeline

On average, this whole process we tell people to expect to take 6 to 9 months, but it can really vary.

We’ve had companies come to us and engage us in late August, early September with a very focused group of buyers and a very specific criteria for getting a deal done and we’ve closed it by the end of that year from engagement to closing in 3 to 4 months.

We’ve also had companies intentionally hire us 6 months or more before going to market.

I can think of one example where we were brought in in January, but the company couldn’t actually close the deal until the following year.

We scheduled things out from there – launched right after Fourth of July, specific dates for NDAs, IOIs, management meetings, all funneling towards a target of closing on January 3rd which was the first business day of the New Year.

In following this process, we found several buyers willing to pay a very attractive price.

We narrowed it down to the one that was the best fit for them, and we closed on time at the valuation that everybody expected.

About Caber Hill Advisors

Caber Hill Advisors is your partner for growth. We’re committed to working with small and middle-market business owners so they can successfully fulfill their personal and professional legacies. We draw on deep industry experience to help our clients identify and capitalize on the best opportunities available.

Across the team is a wealth of expertise in serving companies in several specialty industries. If you’re interested in learning more, contact any of our leading advisors to discuss what’s important to you, your business, and your future.